What is Investment Banking?

Investment Banking is the special division in banks or financial institution that helps individuals or organizations raise capital and provide financial consultancy services to them.

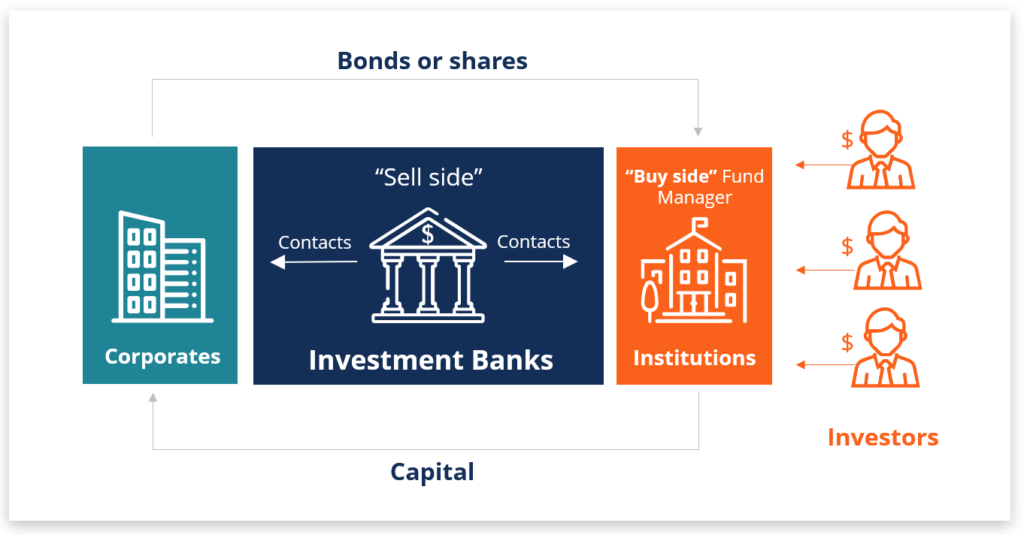

They act as a bridge between investors (who have money to invest) and firms (who require capital to grow and run their businesses).

The main difference between investment banking and commercial banking is that investment banks deals with buying and selling of stocks and bonds for companies, and also helps them to issue IPOs. Whereas, commercial banks primarily deals with deposits and loans for individuals and companies.

How Investment Banking Work?

Investment banks are divided into two sides – The Buy Side and The Sell Side, however many investment banks offer both side services.

The Buy Side works with mutual funds, hedge funds, pension funds and helps the investing public to maximize their returns when trading or investing in securities such as bonds and stocks.

Example – If an investor want to purchase 1000 shares of XYZ Company, he can request for the services from an investment bank, where stock broker will place an order and deliver these shares.

The Sell Side refers to selling shares of newly issued IPOs, placing new bond issues, and helping clients to facilitate transactions.

Example – Suppose XYZ Company plans to issue new shares of stock in an IPO (Initial Public Offering). The company can solicit an investment bank to underwrite shares, and market and sell them to their clients. This way the investment bank raises the capital, which XYZ Company hopes to gain from the issue of the new shares.

What are the Roles of Investment Banks?

Investment bankers play a major role in number of financial activities undertaken by governments and organizations –

1. Stock and Bond Offering

The primary role of Investment Bankers is to facilitate capital funding through investment in either private organization or public entities. Bankers provide organizations with financing through activities such as underwriting the issuance of bonds or stocks (which means to find buyers for investors). This is done through “Initial Public Offering” (IPO), the investment bank is the entity who handles the IPO.

An investment bank is responsible for creating a prospect to explain the public about the company and the terms and conditions of the stock offering, handling all the legal and compliance issues, and setting the price of stock that will hopefully attract sufficient investment to obtain the minimum finance that company requires.

2. Mergers & Acquisitions

Investments banks also assist clients in transactions such as mergers and acquisitions (M&A) where one firm seeks to acquire another firm or when a firm is offered for sale.

For companies who wants to make an acquisition, bank advice their client about the market value of the company being acquire and about the most favorable way to form a proposal.

For companies who is targeted for acquisition, investment bank advice their client by determining a reasonable asking price for the company, and also by advising client on favorable or unfavorable structures of the sales.

Acquisition deals can be done in all cash, stock swaps, or a combination of cash and stock.

3. Arranging Private Placements

Not all company wants to go public. Investment bankers also help clients who prefer to raise capital through private placements rather than on the stock markets.

In private placement, a company could sell an entire offering of stock/bond to a single investor such as an insurance company. It is the fastest and easiest way to raise funds.

4. Sales & Trading (S&T)

The Sales & Trading group of investment bank helps institutional investor clients – such as asset management firms, to buy and sell securities like options, stocks, and bonds to earn higher return.

5. Research

The research division group of investment bank writes reports about the firms and their prospects, often accompanied by buy, sell, or hold ratings.

For example, if bankers like a firm’s prospects, they may issue a favorable Buy Report about the company to encourage more trading to earn higher commissions.

Reference

- https://www.investopedia.com/terms/i/investment-banking.asp

- https://www.investopedia.com/articles/personal-finance/042215/what-do-investment-bankers-really-do.asp

- https://corporatefinanceinstitute.com/resources/careers/jobs/investment-banking-overview/

- https://economictimes.indiatimes.com/definition/investment-banking

- https://www.thebalance.com/what-is-an-investment-bank-357318

- https://www.mergersandinquisitions.com/investment-banking/

- https://www.wallstreetprep.com/knowledge/about-investment-banking/

- https://www.goldmansachs.com/careers/divisions/investment-banking/

- https://strategiccfo.com/investment-banking/

- https://chiefexecutive.net/what-investment-banks-do/

- https://cleartax.in/g/terms/investment-banking