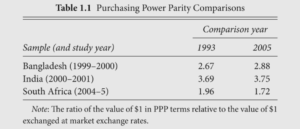

Difference of Purchase power parity Comparison from 1993 to 2005

The World Bank said in 2005 that 2.5 billion people live on less than $2 per person, per day. Researchers Daryl Collins, Jonathan Morduch, Stuart Rutherford and Orlanda Ruthven say the poor rarely spend all the money they get. After using financial diaries to track the day-to-day monetary activities of more than 250 households in Bangladesh, India and South Africa, the authors report that the poor are active money managers who handle relatively large cash flows and usually build savings into their “portfolios.” The authors believe international development efforts should provide poor households with better financial tools for managing their current incomes. The authors describe the challenges and strategies of impoverished households, and paint academically restrained – but still touching – portraits of individual families. This meticulous research and its conclusions to international development workers, microbankers, nongovernmental organisation officials and social entrepreneurs. Micro finance providers will find guidance to tailoring products to fit the complexity of poor people’s lives.

This book summary explains why the developed world’s view of global poverty is inaccurate. Extreme poverty does not turn people into charity cases, unable to help themselves. In fact, those who live in poverty are incredibly smart financially, and have many complex networks for raising capital and making investments.

Chapter One The Portfolios of the Poor

- The countries we refer to here, as well as the three countries where we collected the diaries- Bangladesh , india and south africa – are all fortunate in that they are not at war or in conflict and have working recognized governments and functioning economies.Some of what we say in this book may not apply to fragile or “failed” states, or areas where there is no monetised economy. Our broad perspectives have been shaped by research completed by a wide range of individuals and organizations and we cite representative studies in the next.

- An excellent source showing how to calculate dollar-per-day estimates from local currency incomes is sillers 2004. More on the world bank International Comparison program and new data can be found at http://www.worldbank.com. The 1993 and 2005 figures in above figure are calculated using consumer prices indices from the International Monetary fund’s International Financial Statistics. The 2005 comparison using PPP conversion rates is the latest available at the time of writing.

- A growing literature indicates that income given to women is more likely to be used for investments in education, children’s nutrition and housing than income given to men. Micro-loans given to women are more likely to be repaid then those given to men.

- Note that this is not unlike patterns found in developed countries. The 2004 US survey of Consumer Finances shows that the share of non-financial assets in total assets is much higher for the lowest income quintile of households than the highest.

- The median household showed an increase of 14 percent in their financial net worth over these 10 months, This was not due to a change in value of these assets, the way we think about a wealthy person’s stock portfolio Rather households were adding to their financial wealth at the rapid rate of 1.4 percent per month. By tracking households accomplish this rapid rate of financial growth by managing to save on average about 20 percent of their income per month.

- By “semiformal providers” we mean microfinance organisations and other non bank providers , such as NGOs, that offer services to poor clients. They are sometimes referred to as “MFIs” – micro finance institutions.

Chapter Two The Daily Grind

- Savings programs indicate similar low balances,In the middle of 2003, the average savings balance at safe save (Bangladesh) was $22 and average savings balance at bank Rakyat Indonesia (BRI) was $75.

- Ramadan arrives two weeks earlier each year, because of differences between the Muslim and the Gregorian calendars. During the research year, it happened to fall in November, along with Diwali.This is one of the main reasons for which disturbed cash flow cycle of the Poor.

- Krishan (framer) Credit card, the name of the first product of its kind from the state bank of india, has become a generic term for similar products offered by other Indian banks, while they carry different names.

Chapter Three Dealing with Risk

- The data are from world bank World Development Indicators, accessed in July 2008. In 2000 the under five child mortality rate was 92 per 1,000 children in Bangladesh, 89 per 1,000 in India and 63 per 1,000 in South Africa. In the United States by comparison the child mortality rate was 8 per 1,000 in 2001.

- On the other hand, the fact of prevalent risk steered the Bangladeshi households aways from making investments that could have led to a stronger livelihoods and living standards.

- The study by Abhijit Banerjee and Esther Duflo (2007), pools world bank household surveys from across the world to present a broad view of the economic lives of the poor. The paper reports on detailed survey data culled largely from world bank and Rand corporation surgery’s conducted between 1988 and 2005, representing the expenditures of tens of thousands of poor households in 13 developing countries

- For small and marginal farmers, on the other hand infrequent and higher premiums may be more manageable but they need to coincide with seasonal cash flows.All this, of course, would create additional costs for LIC agents and perhaps require a higher commission.

Chapter Four Building Block :Creating Usefully Large Sums

- Behavioural economics combines perspectives from psychology and economics. Among the lessons are that assuming the ability to act with perfect foresight and rationality, a staple of twentieth-century economics, ignores the self-discipline problems that challenge rich and poor alike. Another lesson is that the way contracts and financial mechanisms are presented can affect their take-up and usage.

- Most poor South africans are dependent on a government provided monthly old-age grant in their retirement .

- Studies have shown that festivals are a major consumer of resources among the poor around the world. See Banerjee and Duflo 2007, which quotes survey results indicating that in several developing countries more than half of all households spend on festivals each year, Fafchamps and Shilpi (2005) found that in Nepal households spend lavishly on festivals as a way of asserting their worth in front of other more economically successful households.

- Grameen Bank’s long-term housing loans had poorer repayment rates and higher write-offs, than its one-year general loans.

Chapter Five The Price of Money

- Muhammad Yunus ( 2007) offers one of the sharpest criticism. The survey data on interest rates for the 350 institutions is given by cull, Demirguc-kunt and Murdoch(2009). Consistent with their findings, Aleem found that the high interest rates charged by informal money lenders in Pakistan reflected the real costs of their lending costs of screening and pursuing delinquent loans in particular in these markets.The general pattern of prices is replicated in other sectors.Prahalad ( 2005) for example compares the prices paid by slum dwellers in Mumbai relative to prices paid by the middle class. He finds the poor paying considerably more for basic things like water, phone calls, diarrhea medicine and rice.In micro finance interest rates over 40 percentage year and more ( after inflation) are certainly part of the landscape while better off customers borrow at rates below 10 percent.

- In this calculation, one would take a monthly, weekly or daily interest rate to the power of the number of months, weeks or days in a year.

- The interest calculations are as follows: His total repayment on the $32 loan was $37.50, which means that he paid $5.50 in interest. If he paid in 50 days, his annual interest rate is ((5.50 / 32 ) * ( 365 /50)) * 100 = 125 %. If he pays the same interest in 330 days, his annual interest rate is ((5.50 / 32 ) * ( 365 /330)) * 100 = 19 % .Neither of these rates are compounded.

Chapter Six Rethinking MicroFinance: The Grameen II Diaries

- Grameen II is vividly described in Dowla and Barua 2006. BRAC was founded in the wake of Bangladesh’s 1971 war of independence and Martha chen’s 1986 volume remains an excellent guide to BRAC’s philosophy and early years.( BRAC is Bangladesh Rural advancement Committee) . The Forbes ranking of the “Top 50 Microfinance Institutions with ASA (Association for Social Advancement) on top is reported by Swibel (2007)

- Grameen II also provides for repayment schedules tailored to individuals borrowers, but ( at least in 2005) field staff were rarely implementing this opportunity.

- Between them, the 37 diarists who took Grameen loans of this sort borrowed $13,225 in the three years repaid $11,347 and ended with $4,455 outstanding. They paid interest of $2,056.

Chapter Seven Better Portfolios

- It is especially important that regulation enables the mobilisation of savings. Where reliable microfinance institutions are not allowed to take savings, poor people are driven to riskier places to store their money. Governments must balance the risk of giving free reign to fraudulent savings collectors with the risk of depriving the poor of opportunities to save in an organised way.

This are my learns and observation from the book