Tokenising Real World Assets (RWAs) involves converting tangible assets like real estate, commodities, and art into digital tokens on a blockchain. This process aims to enhance investment accessibility, liquidity, and efficiency, particularly in impact investing. Here’s an explanation of how this works with an example.

What is Tokenising Real World Assets?

Tokenisation refers to the process of creating a digital representation of a physical asset on a blockchain. Each token represents ownership rights or a share in the underlying asset, allowing for easier transfer and trade. This method democratises access to investments by enabling fractional ownership, where investors can buy portions of high-value assets instead of needing to purchase them outright.

Key Benefits of RWA Tokenization

- Fractional Ownership: Investors can own a fraction of expensive assets (e.g., a portion of a property worth $1 million).

- Increased Liquidity: Tokenized assets can be traded on digital platforms 24/7, improving market liquidity compared to traditional markets.

- Global Accessibility: Investors from various geographical locations can easily access tokenized assets, breaking down barriers that typically limit participation.

- Efficiency and Transparency: Blockchain technology ensures secure and transparent ownership records, reducing fraud risk and simplifying transactions.

Example: Tokenising Real Estate for Impact Investment

Scenario

Imagine a community-focused real estate project aimed at developing affordable housing in an urban area. The project developers want to raise funds while also ensuring that local investors can participate.

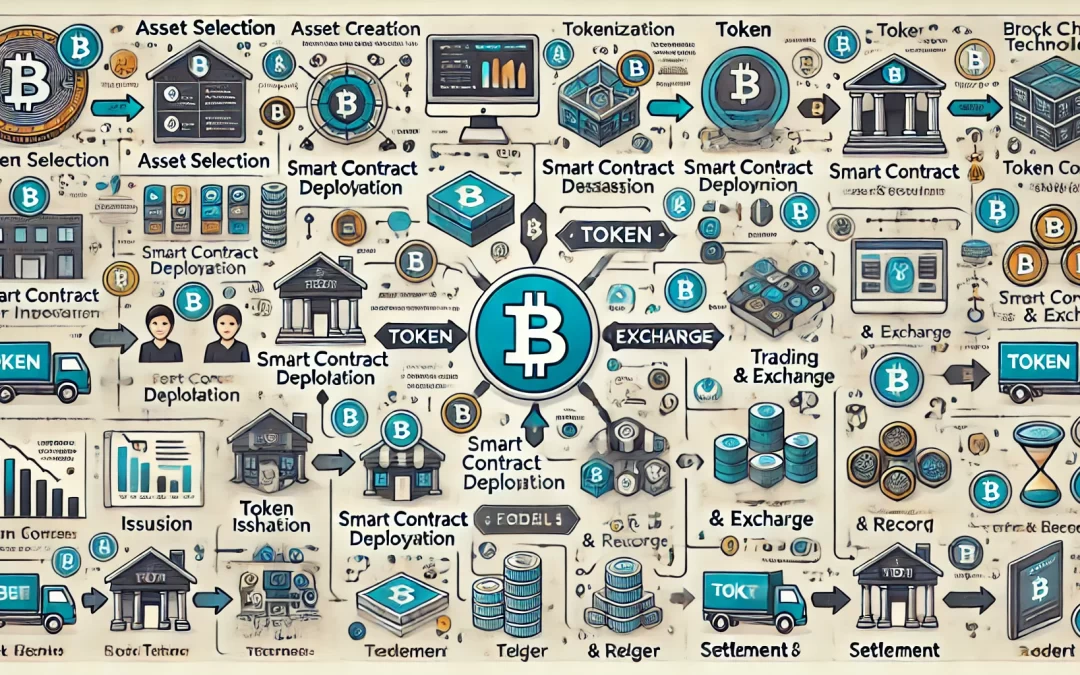

Steps Involved in Tokenisation

1. Asset Selection

- Description: The process begins with choosing an asset that can be tokenized. This could be a physical asset like real estate, an intangible asset like intellectual property, or even a financial instrument like stocks.

- Objective: To identify a valuable asset that can benefit from being represented as a digital token for easier transfer, fractionation, and ownership tracking.

2. Token Creation (Minting)

- Description: After selecting the asset, a digital token is created (or “minted”) on the blockchain. This token represents a digital form of ownership or value tied to the asset.

- Objective: To produce a unique token that accurately represents the asset, usually following the standards of the blockchain platform (like ERC-20 for Ethereum).

- Outcome: The token is added to the blockchain, with attributes like the total supply, name, and symbol.

3. Smart Contract Deployment

- Description: A smart contract is a self-executing code on the blockchain that governs the token’s behavior, including rules for transfer, trading, and ownership rights.

- Objective: To automate and enforce the token’s terms of ownership, transferability, and legal compliance.

- Outcome: A trustless system for managing the token that removes intermediaries, as the smart contract automatically enforces conditions without human intervention.

4. Token Issuance and Distribution

- Description: Tokens are distributed or sold to investors, customers, or stakeholders. This could be done through various mechanisms, such as Initial Coin Offerings (ICOs), Security Token Offerings (STOs), or private sales.

- Objective: To ensure the token reaches the target audience or stakeholders interested in purchasing or holding a share in the asset.

- Outcome: Tokens are in circulation, representing fractional or full ownership of the underlying asset.

5. Trading and Exchange

- Description: Once issued, tokens can be bought, sold, or traded on secondary markets or decentralized exchanges.

- Objective: To provide liquidity and an open market for token holders to freely trade their tokens, increasing asset accessibility.

- Outcome: Token holders can sell their shares or acquire more, and new investors can participate in the token economy, adding flexibility for both buyers and sellers.

6. Settlement and Record-Keeping

- Description: The final stage involves recording transactions and ensuring that the blockchain ledger is updated to reflect ownership changes.

- Objective: To maintain a secure and transparent record of all transactions involving the token, providing verifiable ownership history.

- Outcome: An immutable, permanent record on the blockchain, allowing for transparent auditing and reducing fraud or ownership disputes.

Outcome

- Enhanced Community Engagement: Local residents feel more connected to the project since they have a financial stake in it.

- Liquidity for Investors: Investors can trade their tokens on secondary markets, providing them with liquidity that traditional real estate investments lack.

- Transparency and Security: All transactions are recorded on the blockchain, ensuring transparency about ownership and investment flows.

Conclusion

Tokenising RWAs like real estate not only opens up investment opportunities for a broader audience but also fosters impact investments that benefit communities. By leveraging blockchain technology, tokenisation enhances liquidity, democratises access to high-value assets, and aligns financial incentives with social goals, making it a powerful tool for modern investing strategies.

Reference

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4885232

- https://economictimes.indiatimes.com/markets/cryptocurrency/understanding-real-world-assets-a-vision-for-penetration-of-tokenization-in-india/articleshow/113729248.cms

- https://www.mckinsey.com/industries/financial-services/our-insights/from-ripples-to-waves-the-transformational-power-of-tokenizing-assets