What is Behavioral Finance?

Behavioral finance is a study of human psychology while making investment decisions and its subsequent effect on market.

Research revealed that investors’ decision making habit is influenced by various psychological biases such as emotions, fear, confidence, over-confidence, greed, and risk that in turn, influences stock markets.

Behavioral study focuses upon this factors, to get a knowledge on how investors interact and take actions on certain information and take such investment decisions. We can say behavioral finance came about as a way to explain the reason behind rational and irrational behavior of investors and market.

Purpose

The purpose of behavior finance is to help us understand why people buy and sell a selective stock? Why investors are ready to take risk by investing a large amount of funds in Startup Companies? And what influenced them to do so?

In behavioral finance, it is assumed that investors are not perfectly rational and self-controlled but rather are psychological influential with a least self-controlling tendencies.

Behavioral finance suggests that the characteristic of participants and the structure of information they have – plays a major role in decision making of others investors as well, which is then overall outcome of the market.

Difference between Traditional Finance and Behavioral Finance

- Traditional finance assumes that an investor’s thinking is rational meaning – he can process information that are unbiased. Whereas, behavioral finance states that’s investor’s thinking is irrational and his emotions plays a major role of decision making in terms of investment.

- According to traditional finance, investors receive unlimited knowledge, data and other sources of information that are always perfect. Whereas, in behavioral finance, all investors doesn’t process same quality/quantity of information.

- Traditional finance believes that investors have self-control over their investments. But behavioral finance states that investors aren’t having full control on their investments. Number of physiological factors indirectly controls the thinking of individual investors.

How Biases influence Investors’ Decision-making Process?

Behavioral finance can be analyzed from various perspectives. One key perspective is the influence of biases. Biases can occur for various reasons.

1) Information Bias

People happen to be more bias towards whatever information they have in their mind. Whether complete or incomplete information. This bias have a huge impact on what decisions investors make for their investment. Any information passes by them that supports their belief, immediately grab their attention.

Example: On January 7, 2021, Elon Musk, founder and CEO of Space X used his twitter handle to tweet a keyword “Use Signal”. Which in quick time affected the Share price of Signal App. Investors without even researching, purchased the company’s shares in large number of quantities assuming that Elon Musk is promoting the social messaging app, ‘Signal‘.

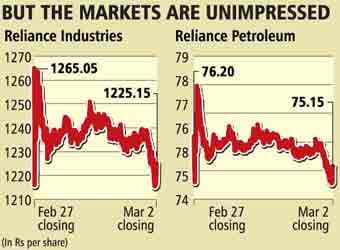

2) Mental Accounting

People buy a particular company’s stock and in future, they get good returns on their investment.

Sometimes, these companies takes a special place in investors’ heart and they reinvest their large amount of funds in the same company, keeping in mind their previous profit, even if they are going in loss. They won’t stop investing in it. Here, loyalty influences decision making ability of maximum investors.

According to research, In December 2020, more than 34% of Indian investors reinvested their funds in Reliance Company’s Shares.

3) Illusion of Control

Many investors make financial decision under the illusion of control. For example, if a fresher (stock market trader) with his own theory invested in a company’s share that later brought him a lot of profit, he will continue to assume that his theory is all that he needs to gain profit in stock market.

Investing in a stock, without analyzing external information or studying current market situation leads to failure and thus heavy loss.

4) Vision Bias

Sometimes investors make predictions without research, if one of their predictions gave them profit, they will continue to predict more. But they forget that stock market is one of the most unpredictable market in the world. No one can ever be 100% sure what will happen in next few hours.

Thus, making decision purely on the basis of future vision is the key to bad decision-making in terms of biases.

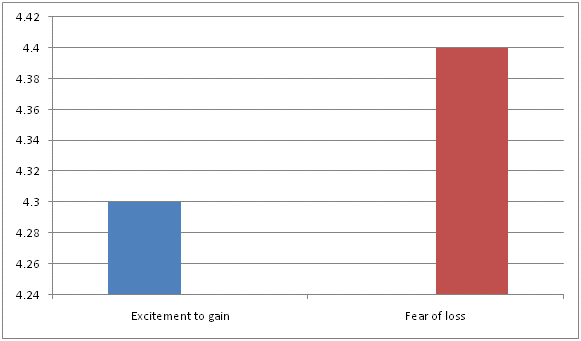

5) The Fear of Loss VS Excitement of Gains

The main reason investors put their huge amount of hard money in a particular stock is to get best profit out of it. But with every investment the probability of losing something is equal to gaining something. However, these two possibilities do not leave same impact on the investors.

According to research, the fear of losing money is lot bigger than the excitement of gaining profit. If an investors loses his money in stock market, he is least likely to invest more income. Thinking that earning profit in stock market is not his cup-of-tea.

6) Multiple Choices for investment

One of the main factor that influences investors’ decision making is the presence of multiple choices.

Options having same brand name, identical products or similar prices tend to confuse investors. In such scenario, instead of making rational choice, they randomly choose one option that can sometimes turn out to be unexpected one in future.

7) Majority flow

Some investors have a great tendency of going with the flow, thinking that majority of investors are inclined to it. This may or may not be the right choice.

This specific biases of the investors can later lead them to big loss.

8) Familiarity Bias

Sometimes investors tend to invest in those company’s stocks that they are familiar with, such as popular brands. As a result, investors isn’t aware of other multiple sectors or types of investments, which have more potential and less risk.

Conclusion

Behavioral finance attempts to explain that investors may not necessarily make decision on the basis of rational analysis of all the available information. This in turn, can lead to movement away from a fair price of a company’s shares, and the market as a whole, to a period where share prices will comparatively high or low.

References

- https://www.investopedia.com/terms/b/behavioralfinance.asp

- https://corporatefinanceinstitute.com/resources/knowledge/trading-investing/behavioral-finance/

- https://blog.finology.in/behavioral-finance/what-is-behavioral-finance

- https://www.behavioralfinance.com/

- https://www.businessinsider.com/what-is-behavioral-finance

- https://www.thestreet.com/personal-finance/education/behavioral-finance-14909070

- https://www.cannonfinancial.com/uploads/main/Behavioral_Finance-Theories_Evidence.pdf

- https://investorjunkie.com/economics/behavioral-finance/

- https://financial-dictionary.thefreedictionary.com/Behavioral+finance

- https://www.sciencedirect.com/topics/economics-econometrics-and-finance/behavioural-finance

- https://catanacapital.com/blog/behavioral-finance-avoid-biases-successful-investment-decisions/